In a significant move to strengthen the power sector and encourage reforms, the Department of Expenditure, Ministry of Finance, has provided financial incentives to states in India. This initiative aims to enhance the efficiency and performance of the power sector and has already garnered positive responses from several state governments.

The Union Finance Minister, in the Union Budget 2021-22, announced the boost to reforms by offering additional borrowing permissions to states. Under this scheme, states can avail themselves of an additional borrowing space of up to 0.5% of their Gross State Domestic Product (GSDP) annually for a period of four years, from 2021-22 to 2024-25. However, the availability of this financial window is contingent upon the implementation of specific reforms in the power sector by the respective states.

Encouraged by this initiative, state governments have proactively initiated the reform process, and numerous states have submitted details of the reforms undertaken and achieved parameters to the Ministry of Power.

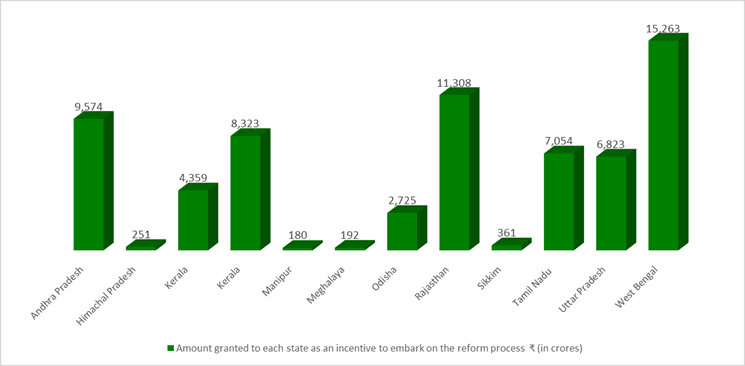

Based on the recommendations of the Ministry of Power, the Ministry of Finance has granted permission to 12 state governments for the reforms undertaken in 2021-22 and 2022-23. Over the past two financial years, these states have been allowed to raise financial resources totalling ₹66,413 crore through additional borrowing permissions.

The breakdown of the amount granted to each state as an incentive to embark on the reform process is as follows:

The availability of additional borrowing permissions linked to power sector reforms will continue in the financial year 2023-24. An amount of ₹1,43,332 crore will be available as an incentive to states for undertaking these reforms in the upcoming financial year. States that were unable to complete the reform process in the previous years, namely 2021-22 and 2022-23, may also benefit from the additional borrowing earmarked for 2023-24 if they carry out the reforms in the current financial year.

The primary objectives of providing financial incentives for power sector reforms are to improve operational and economic efficiency within the sector and promote a sustained increase in paid electricity consumption.

To be eligible for these incentives, state governments must undertake a set of mandatory reforms and meet stipulated performance benchmarks. These reforms include assuming progressive responsibility for losses of public sector power distribution companies (DISCOMs), ensuring transparency in the reporting of financial affairs of the power sector, complying with legal and regulatory requirements, and timely rendition of financial and energy accounts.

Upon completion of these reforms, a state’s performance is evaluated based on specific criteria to determine its eligibility for the incentive amount. The evaluation criteria encompass various factors such as metered electricity consumption, subsidy payment through Direct Benefit Transfer (DBT) to consumers, reduction in Aggregate Technical & Commercial (AT&C) loss, reduction in Average Cost of Supply and Average Realizable Revenue (ACS-ARR) Gap, reduction in cross subsidies, payment of electricity bills by government departments and local bodies, installation of prepaid meters in government offices, and the use of innovations and innovative technologies. Bonus marks are also awarded for the privatization of power distribution companies.

The Ministry of Power acts as the nodal ministry responsible for assessing the performance of states and determining their eligibility for granting additional borrowing permissions.

With the financial incentives in place, states in India are motivated to accelerate power sector reforms, leading to improved efficiency, reduced losses, and ultimately a more robust power infrastructure that benefits consumers and the overall economy.