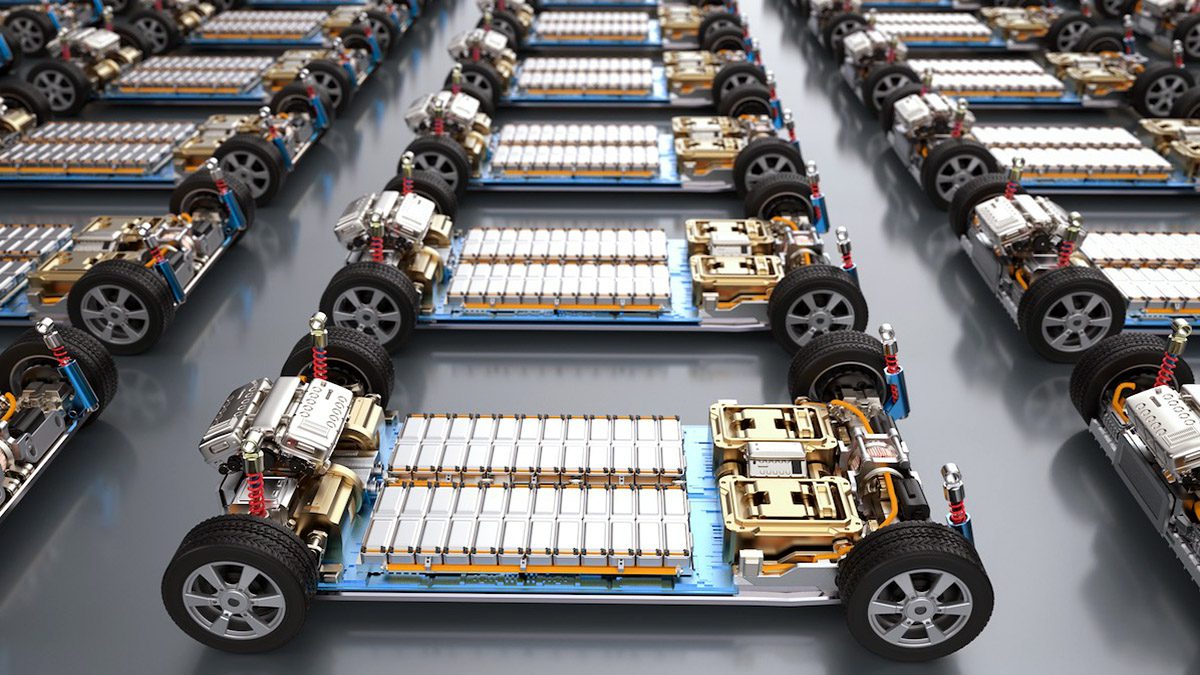

GFCL EV Products Ltd (GFCL EV), a subsidiary of Gujarat Fluorochemicals Ltd. (GFL), has unveiled a groundbreaking investment plan totalling ₹6,000 Crores over the next 4-5 years. The investment aims to bolster the supply chain for Electric Vehicle (EV) and Energy Storage System (ESS) batteries, with an anticipated production capacity of approximately 200 GWh annually.

A significant portion of the investment, around ₹650 Crores, has already been allocated by December 31, 2023. This forward-looking initiative underscores GFCL EV’s commitment to driving innovation and sustainability in the electric mobility sector.

With an eye towards future growth, GFCL EV is strategically positioning itself in high-demand regions such as the US, Europe, and India. Leveraging initiatives like the IRA Act, China plus One strategy, and the Production-Linked Incentive (PLI) scheme, the company is poised to tap into burgeoning markets while aligning with its vision for sustainable solutions.

The company has already initiated long-term partnerships with renowned global customers, signalling confidence in its capabilities and offerings. GFCL EV aims for an asset turnover ratio of 2 times the CAPEX and an EBITDA margin exceeding 25%, indicating a strong profitability and returns profile in the coming years.

Speaking on the occasion, Vivek Jain, Chairman of INOXGFL Group, emphasised GFL’s visionary investment and dedication to innovation. He highlighted the company’s pivotal role in shaping the future of the EV and ESS battery industry, aiming not only for market prominence but also to pioneer environmentally sustainable solutions.

Dr Bir Kapoor, CEO and DMD of Gujarat Fluorochemicals Ltd., underscored GFCL EV’s strategic position in contributing to the energy transition driven by EV/ESS technologies. He emphasised the company’s commitment to environmental consciousness and innovation, envisioning a future where technology meets sustainability.

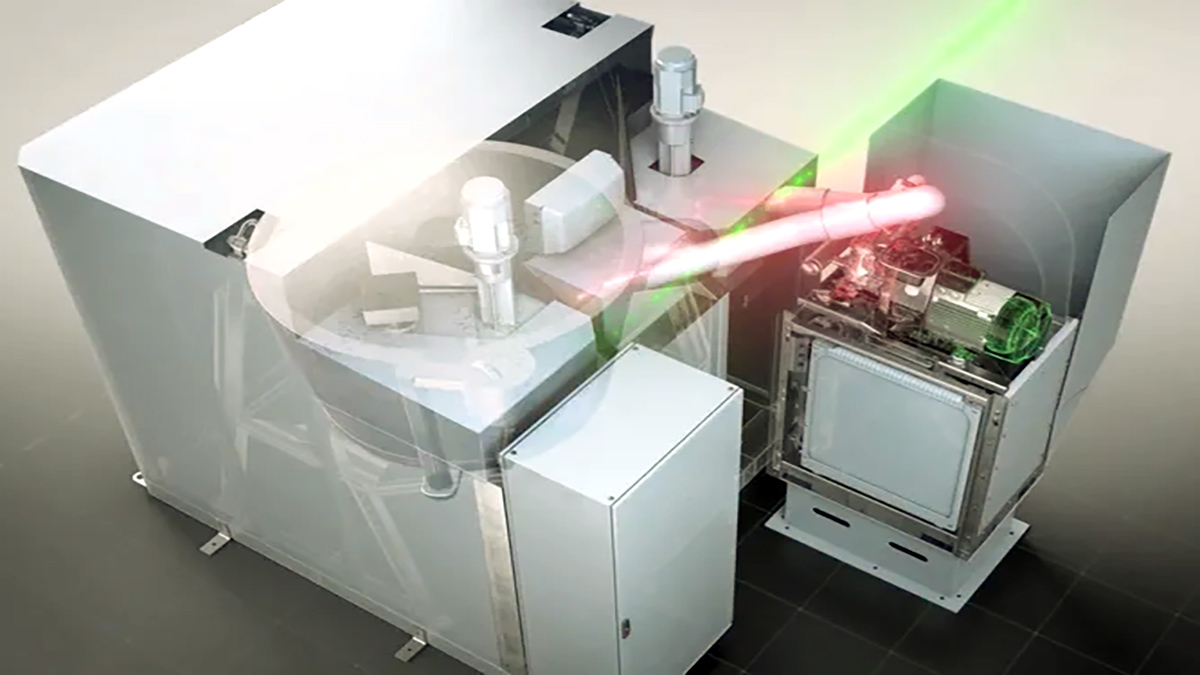

GFCL EV’s product portfolio includes electrolyte salts like LiPF6, additives, electrolyte formulations, cathode active materials such as LFP, and specialised offerings for sodium ion batteries. The commercial plant for the LiPF6 Project has already achieved commercial production, with validation processes underway. The LFP project is expected to be operational by Q3 of CY 24, catering to 30% of the Lithium-ion battery (LiB) value.

The global EV battery market is projected to reach $300 billion by 2030, presenting significant opportunities for industry players. In the domestic context, GFCL EV’s entry into the EV segment is strategic, considering the anticipated growth of around 30% in the industry between 2022 and 2030. This move not only addresses challenges such as the high cost of EV batteries but also reduces import dependence on key battery raw materials, positioning GFL at the forefront of India’s electric mobility revolution and Energy Transition.