India’s flagship overseas firm ONGC Videsh has less than $100 million of dividend income lying in Russia because of the Ukraine conflict, but the company is not in a hurry to bring it back, a senior official said on Monday. Indian state oil firms have invested $5.46 billion in buying stakes in four different assets in Russia. These include a 49.9% stake in the Vankorneft oil and gas field and another 29.9% in the TAAS-Yuryakh Neftegazodobycha fields.

They get dividends on profits made by the operating consortium from selling oil and gas produced from the fields. Soon after invading Ukraine in February last year, Russia put restrictions on repatriation of dollars to check volatility in foreign exchange rates.

OVL, the overseas arm of state-owned Oil and Natural Gas Corporation (ONGC), got its last dividend back in July 2022. One dividend payout that came after that is lying in the company’s account in Russia.

Its MD, Rajarshi Gupta, said the dividend income lying in Russia is less than $100 million.

“We are not in a hurry to get it back as the company has capital and operating expenses for the three projects in Russia,” he said. “It is business as usual as far as dividend is concerned.”

OVL holds interest in Russia through a Singapore subsidiary.

Moscow declared Singapore as an unfriendly nation last year, and so money from Russia cannot flow to any company incorporated in that country.

He said the company is looking at right banking channels and discussions are on. Last week, Oil India officials said $300 million dividend income of the company and its partners are stuck in Russia.

The consortium of OIL, Indian Oil Corporation (IOC) and Bharat PetroResources Ltd has stakes in two projects.

$300 million dividend was lying with the Commercial Indo Bank LLC (CIBL), which was a joint venture of State Bank of India and Canara Bank. Canara Bank in March sold its 40% stake in CIBL to SBI.

The dividend from TAAS was paid on a quarterly basis, while Vankorneft’s earnings were paid half-yearly. The Indian firms are looking at options of how to repatriate the money from Russia, he said.

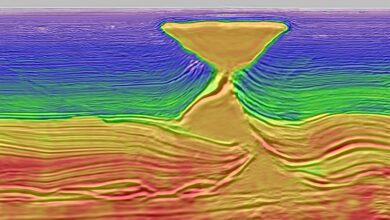

OVL holds a 26% stake in Suzunskoye, Tagulskoye and Lodochnoye fields — collectively known as the Vankor cluster in the north-eastern part of West Siberia.

Indian Oil Corp (IOC), Oil India Ltd (OIL) and Bharat PetroResources Ltd (a unit of Bharat Petroleum Corp Ltd or BPCL) hold another 23.9% in Vankor. Russia’s Rosneft is the operator with 50.1% interest.

The consortium of OIL, IOC and Bharat PetroResources has a 29.9% stake in TAAS-Yuryakh Neftegazodobycha. The operations of the fields have not been impacted and they continue to produce as normal.

OVL also has a 20% stake in the Sakhalin-1 oil and gas field in Far East Russia, and in 2009 acquired Imperial Energy, which has fields in Siberia, for $2.1 billion.

OVL, which has 32 oil and gas properties in 15 countries from Venezuela to Vietnam, had seen oil production fall to 6.349 million tonne in 2022-23 fiscal (April 2022 to March 2023) from 8.099 million tonne in the previous year.

Gas output also dipped to 3.822 billion cubic meters from 4.231 bcm in 2021-22. The lower production was because of halting of operations at Sakhalin-1 for seven months after operator Exxon declared force majure post Ukraine war.

But higher oil prices help it post a net profit of ₹1,700 crore in FY23 as against a PAT of ₹1,589 crore in the previous fiscal.