Honeywell has announced the acquisition of Air Products’ liquefied natural gas (LNG) process technology and equipment business. The $1.81 billion all-cash transaction represents approximately 13x the estimated 2024 EBITDA.

The acquisition will enable Honeywell to offer a comprehensive, top-tier solution for managing energy transformation, combining natural gas pre-treatment with state-of-the-art liquefaction, utilising digital automation technologies unified under the Honeywell Forge and Experion platforms. This integration promises efficient, reliable, and optimised management of natural gas assets, delivering unparalleled value and support.

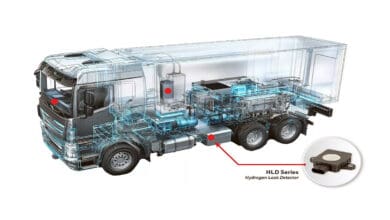

Currently, Honeywell provides pre-treatment solutions for LNG customers globally. The addition of Air Products’ complementary LNG process technology and equipment business, which includes the design and manufacturing of coil-wound heat exchangers (CWHE), will significantly expand Honeywell’s capabilities. CWHEs are known for their high throughput of natural gas, small footprint, and robust, reliable operations both onshore and offshore.

“Natural gas is a critical lower-emission and affordable transition fuel that will help meet the ever-increasing and dynamic global energy demands,” said Vimal Kapur, Chairman and CEO of Honeywell. “This highly complementary acquisition will strengthen our energy transition portfolio and create new opportunities for growth in aftermarket services and digitalisation through our Honeywell Forge platform.”

Air Products’ decision to divest its LNG business aligns with its strategy to focus on its core industrial gas business and clean hydrogen solutions. “The LNG business is at its strongest point in its history thanks to our outstanding team, and they will be in good hands with Honeywell,” said Seifi Ghasemi, Chairman, President, and CEO of Air Products.

The LNG market has seen significant growth, quadrupling over the past 20 years and is expected to double over the next two decades. Honeywell’s acquisition positions it to capitalise on this growth, particularly in key markets such as power and data centres.

Ken West, President and CEO of Honeywell’s Energy and Sustainability Solutions segment, emphasised the benefits of the acquisition, stating, “The integration of this talented team and the acquired proprietary technologies will enable Honeywell UOP to bring a full spectrum of scalable solutions and services to help our global customers navigate the complex journey to more sustainable and efficient energy practices.”

Air Products’ LNG business employs approximately 475 people and is headquartered in Allentown, Pennsylvania, with a 3,90,000-square-foot manufacturing facility in Port Manatee, Florida. This facility produces all sizes of CWHEs.

This acquisition is the fourth announced by Honeywell this year as part of its capital deployment strategy. The company aims for high-return acquisitions that drive future growth across its portfolio, which aligns with the megatrends of automation, the future of aviation, and energy transition.

The transaction is expected to close before the end of the calendar year, subject to customary closing conditions, including regulatory approvals. It is also expected to be adjusted earnings per share accretive in the first full year of ownership.