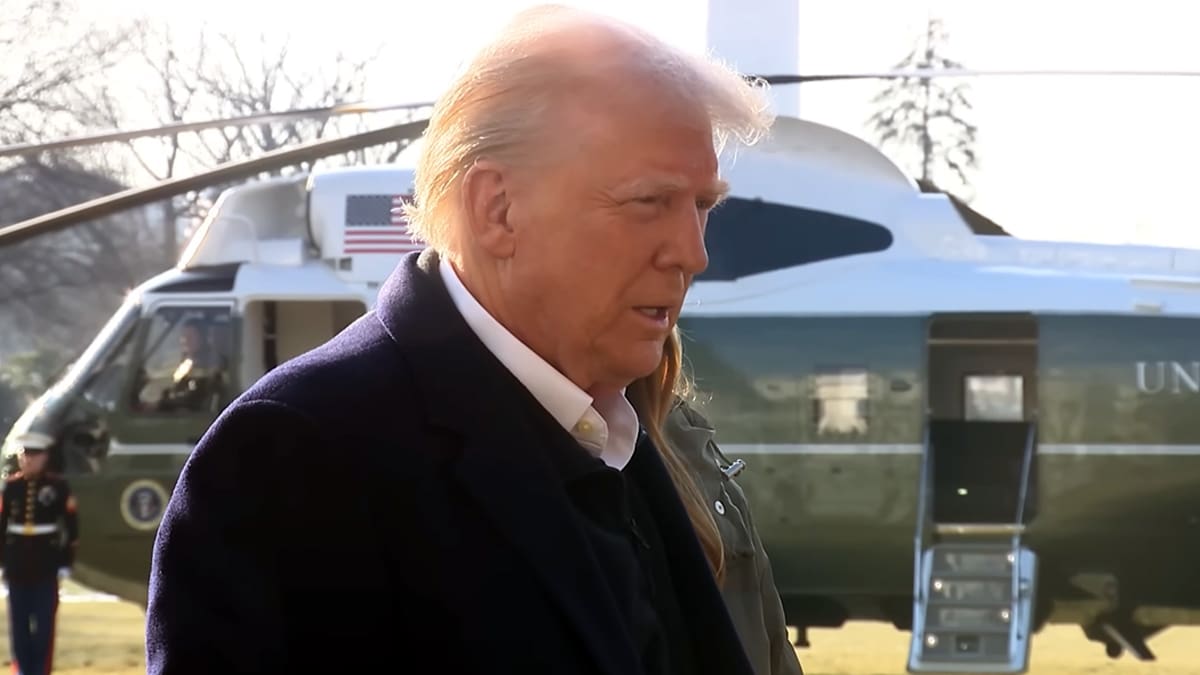

In January 2025, President Donald Trump began his second term, enacting policies that have significantly impacted global renewable energy and international trade. These measures have created both challenges and opportunities, particularly for Asian economies, with India positioned to navigate this evolving landscape strategically.

The shift in US commitment to Renewable Energy

One of President Trump’s first actions was signing Executive Order 14162, “Putting America First in International Environmental Agreements,” leading to the immediate withdrawal of the United States from the Paris Agreement. This marked the second time under Trump’s leadership that the US exited the global climate pact, citing a preference for market-driven solutions over regulatory constraints.

The abrupt policy shift has introduced uncertainty into the US renewable energy sector. In 2024, the country witnessed a record-breaking addition of 48.2 gigawatts (GW) of renewable energy capacity, driven largely by incentives under the Inflation Reduction Act of 2022. However, with the new administration prioritising fossil fuels and rolling back federal support for clean energy, experts warn that the United States could lose its competitive edge in the global renewable market.

A major consequence of this policy reversal is the freeze on federal loans and grants supporting green energy initiatives. Rural businesses and farmers who invested in renewable projects, particularly through programs like the Rural Energy for America Program (REAP), now face financial uncertainty. The lack of support could slow down grassroots-level renewable energy adoption and impact job creation in the sector.

Reshaping global trade: The new tariff strategy

President Trump’s “America First” agenda includes imposing steep tariffs on imports from key trading partners, including China, Mexico, and Canada. The proposed tariffs involve a 60% duty on Chinese imports and additional levies ranging from 10% to 20% on goods from other countries. This strategy aims to boost domestic manufacturing and reduce dependence on foreign suppliers. However, it is expected to disrupt global trade flows, forcing companies to reconsider their supply chain strategies and explore alternative manufacturing hubs.

Impact on Asia: A mixed bag of challenges and opportunities

The imposition of new tariffs has created challenges for many Asian economies that rely on exports to the United States. China, in particular, faces the direct impact of increased levies, which could slow down its manufacturing sector. This shift may prompt multinational corporations to diversify their supply chains, seeking alternatives to mitigate risks associated with over-reliance on Chinese production.

India stands at a crossroads in this realignment. On one hand, it faces potential setbacks due to reciprocal tariffs that could impact its export-driven industries, particularly chemicals, metal products, jewellery, automobiles, pharmaceuticals, and food processing. In 2024, India exported nearly $74 billion worth of goods to the US, with significant shares in the pearls, gems, and petrochemical sectors. If the US imposes reciprocal tariffs, India’s export revenue could take a hit of approximately $7 billion annually.

India’s existing tariff policies also come under scrutiny. The country currently imposes an average tariff of 11%, significantly higher than the US’s duties on Indian exports. Conversely, American exports to India, valued at $42 billion in 2024, face import duties ranging from 7% to 68%. If the US enforces broader tariffs, India’s agriculture, farm exports, and processed food industries could be severely affected, whereas sectors like textiles and leather might face minimal impact due to their lower tariff differentials.

Opportunity for India in the shifting global trade landscape

Despite the potential challenges, India finds itself in a unique position to benefit from shifting global supply chains. As multinational companies look for alternative manufacturing bases beyond China, India emerges as a viable destination due to its large workforce, improving ease of doing business, and strategic policy reforms. Key sectors poised to gain include pharmaceuticals, information technology, and automotive components, as global companies explore diversification strategies.

Strengthening US-India relations also plays a crucial role in this transition. Both nations have ongoing collaborations in defence, security, clean energy, and technology, which could facilitate better market access for Indian exports. However, India must navigate these opportunities carefully, balancing the advantages of deeper US economic ties with its broader strategic interests in Asia and beyond.

Navigating the new economic landscape

President Trump’s second term policies are reshaping global trade and energy dynamics, creating both risks and opportunities for emerging economies like India. While reciprocal tariffs pose a significant challenge to India’s exports, the evolving supply chain landscape offers a chance for India to position itself as a critical manufacturing hub.

By proactively addressing trade imbalances, investing in infrastructure, and fostering a business-friendly environment, India can capitalise on these changes and enhance its standing in the global economy. The coming months will be crucial as India adapts to these shifts, aiming to convert potential trade adversities into avenues for long-term economic growth and development.