India is rapidly emerging as a significant player in the green hydrogen economy, with a focus on leveraging its renewable energy potential to develop green hydrogen and its derivatives like ammonia and methanol. The International Renewable Energy Agency (IRENA) report, Global Trade in Green Hydrogen Derivatives, outlines the global landscape and opportunities for nations, including India, to position themselves in the green hydrogen sector. The report emphasises the importance of regulatory frameworks, standardisation, and certification in fostering an environment for green hydrogen trade—a concept that is central to India’s green energy ambitions.

India’s Green Hydrogen Strategy

India’s green hydrogen strategy aligns with its commitment to the Paris Agreement and the goal of achieving net-zero emissions by 2070. The government’s National Green Hydrogen Mission, launched in 2023, is set to drive the production of green hydrogen, targeting both domestic utilisation and exports. Key to this mission is leveraging India’s abundant solar and wind resources to power the electrolysis processes needed to produce green hydrogen sustainably.

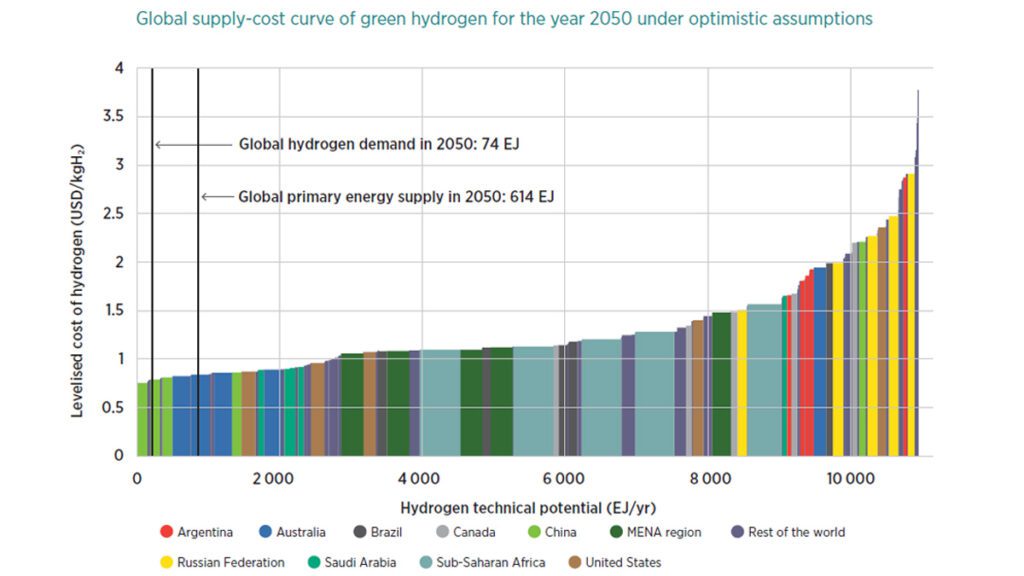

According to IRENA, hydrogen and its derivatives could meet 14% of global energy demand by 2050. For India, this represents a vast opportunity, as the country has the potential to produce green hydrogen at competitive costs due to its renewable energy capabilities and land availability. The IRENA report’s optimistic supply-cost curve highlights India as one of the few regions with potential for cost-competitive green hydrogen production by 2050, making it an attractive supplier for regions with less production potential, such as Japan, South Korea, and parts of Europe.

Trade Potential for Green Hydrogen Derivatives

India’s growing demand for green hydrogen derivatives like ammonia and methanol is driven by the industrial and agricultural sectors. Ammonia is particularly relevant for India, as it is a vital input in fertiliser production, which supports the country’s vast agricultural economy. IRENA projects that the global demand for ammonia, largely driven by agriculture, will significantly increase by 2050. Given India’s reliance on ammonia imports to meet domestic demand, the transition to green ammonia could position the country as both a producer and an exporter of sustainable fertilisers.

Methanol, another crucial derivative, plays a significant role in chemical industries and fuel production. India’s methanol market is also poised for transformation, as the government seeks to reduce its dependency on imported fuels and pivot towards cleaner alternatives. However, producing green methanol requires access to renewable carbon sources and green hydrogen. IRENA’s report indicates that India could take advantage of the low-cost renewable energy available to produce green hydrogen and use it to develop a competitive methanol sector.

Regulatory Landscape and Certification Challenges

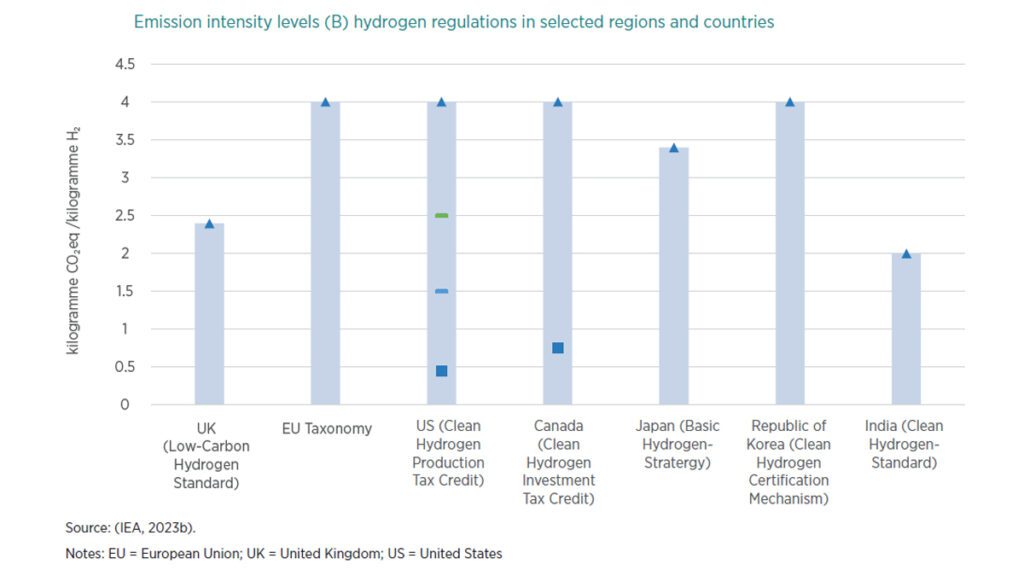

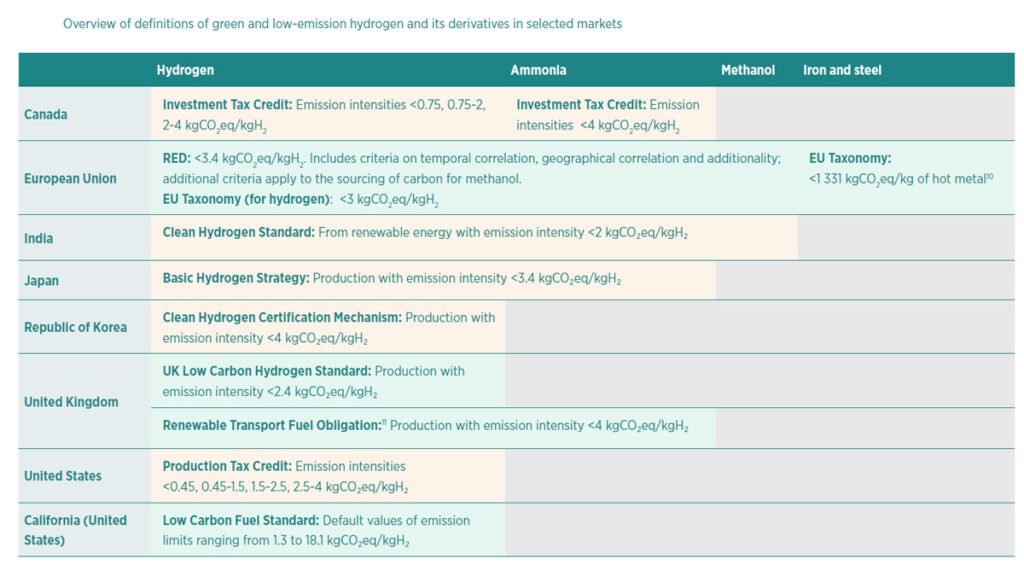

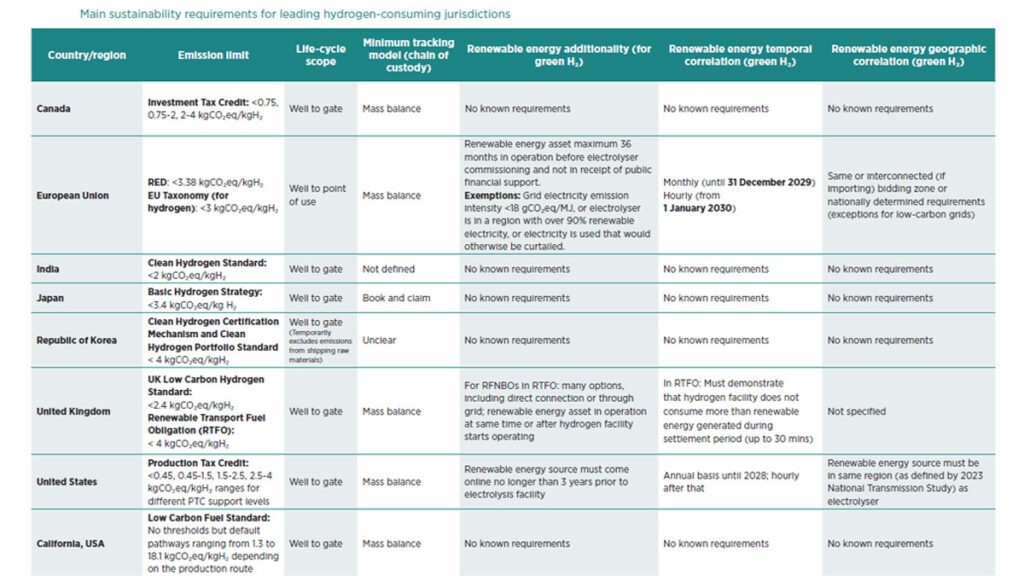

To support the green hydrogen trade, India has introduced its own Clean Hydrogen Standard, which sets a benchmark of an emission intensity below 2 kg of CO₂ per kg of hydrogen. This places India among the global leaders in defining stringent emission standards for green hydrogen production. The IRENA report identifies this standardisation as essential to ensuring that green hydrogen and its derivatives meet international trade requirements.

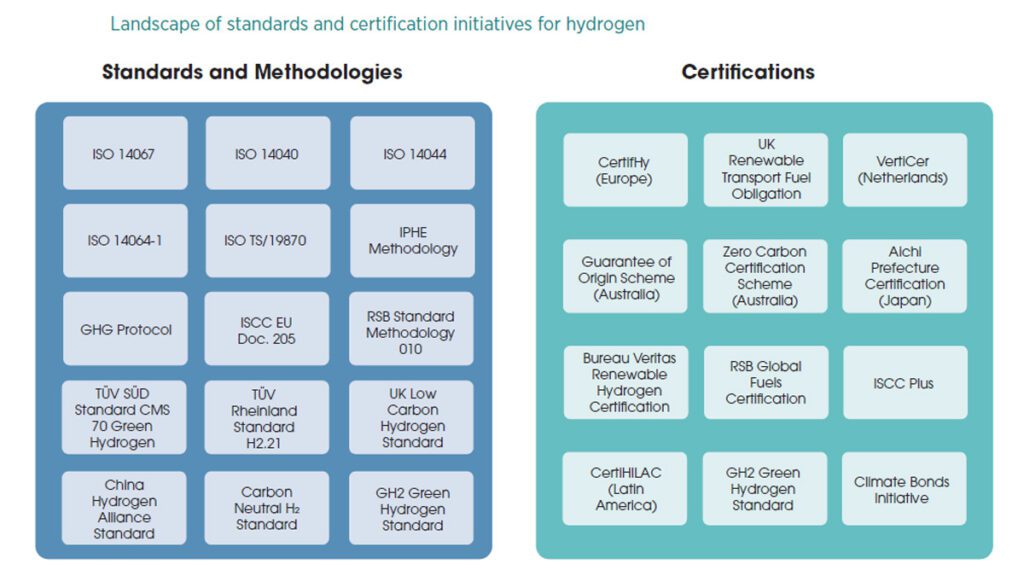

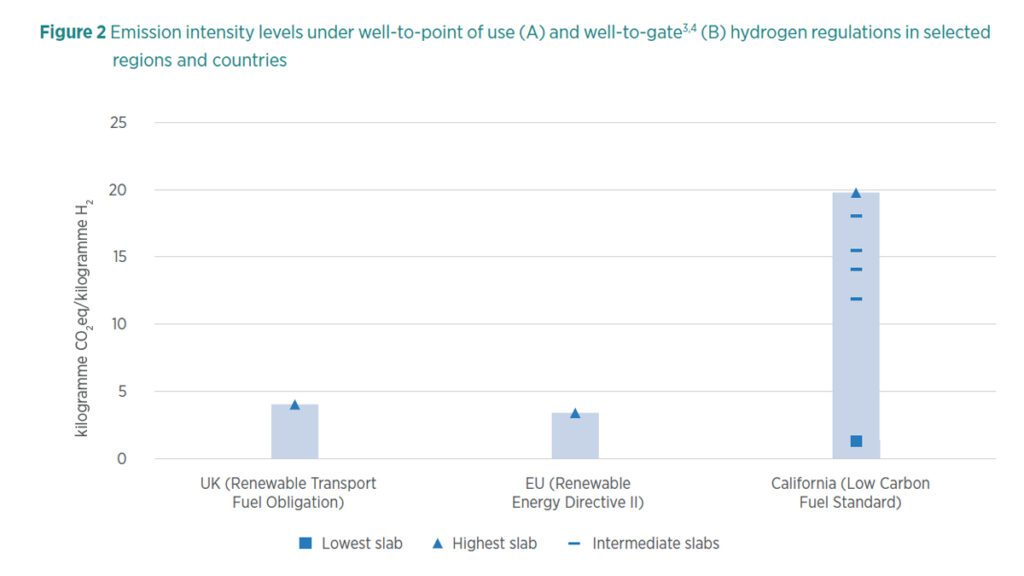

Despite progress, India faces challenges in aligning its regulations with international standards. The IRENA report highlights the need for interoperability among regulatory frameworks, especially between regions with different definitions and requirements for low-emission hydrogen and derivatives. Aligning with standards such as the European Union’s Renewable Energy Directive and the US Inflation Reduction Act could facilitate India’s access to these lucrative markets.

Carbon Border Adjustment Mechanism (CBAM) and Implications for India

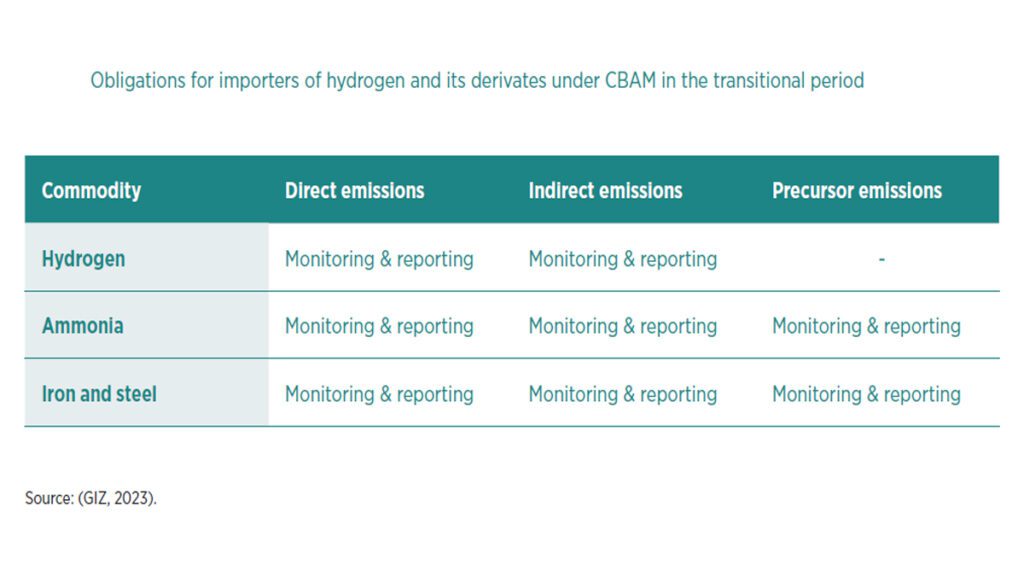

The European Union’s Carbon Border Adjustment Mechanism (CBAM) represents a critical policy impacting India’s export potential in green hydrogen derivatives. CBAM imposes an additional cost on imports to the EU based on their carbon emissions, covering sectors like steel, aluminium, and fertilisers. As one of the world’s leading steel producers, India must adapt to the EU’s emission regulations to maintain its competitive edge.

IRENA’s report suggests that India could mitigate CBAM-related challenges by developing robust certification schemes for its green hydrogen and derivative exports. These schemes would need to align with the EU’s stringent sustainability requirements, including criteria for additionality, temporal correlation, and geographic correlation of renewable electricity. Establishing such schemes would position India as a reliable source of certified green hydrogen products, enhancing its access to the European market.

Developing Infrastructure for Green Hydrogen Export

To realise its ambitions as a global supplier, India must invest in the infrastructure needed to transport green hydrogen and its derivatives. While hydrogen can be moved through pipelines over shorter distances, long-distance trade often involves derivatives like ammonia, which are easier to transport. According to IRENA, nearly 45% of the hydrogen traded by 2050 is expected to be in the form of ammonia, underscoring the importance of building facilities for ammonia storage and shipping.

India’s strategic geographic location provides a logistical advantage for exporting green ammonia to countries in Southeast Asia, Japan, and even parts of Europe. By developing dedicated ports, storage facilities, and liquefaction plants, India could strengthen its position in the global green hydrogen market.

Strengthening India’s Green Hydrogen Ecosystem

Based on IRENA’s insights, India can undertake several steps to enhance its role in the global green hydrogen economy:

- Enhance Regulatory Alignment: India should work towards aligning its certification schemes with those in key import markets such as the EU, US, and Japan. By doing so, Indian exporters can navigate these markets more efficiently, ensuring compliance with sustainability standards.

- Expand Domestic Production of Green Hydrogen Derivatives: Increasing the domestic production of green ammonia and methanol will not only reduce India’s dependency on imports but also provide export opportunities. Integrating green hydrogen production with India’s existing fertiliser and chemical industries can reduce costs and improve emissions performance.

- Invest in Infrastructure for Derivative Transport and Storage: Building specialised facilities for storing and transporting hydrogen derivatives like ammonia and methanol will support India’s export potential. Public-private partnerships can drive investments in these areas, helping India capitalise on its geographical advantages.

- Promote Research and Innovation: Developing indigenous technologies for electrolysis, renewable integration, and carbon capture will reduce production costs for green hydrogen. Government-supported research initiatives, along with collaborations with global technology leaders, could accelerate advancements in these areas.

- Engage in International Collaboration: India should participate in international platforms focused on hydrogen regulation and certification. By actively engaging in forums led by organisations like IRENA and the WTO, India can contribute to shaping global standards. It would ensure that its interests are represented in the emerging green hydrogen trade ecosystem.

India’s green hydrogen strategy holds significant promise, with the potential to transform the nation into a global supplier of sustainable energy. However, realising this potential will require overcoming regulatory, infrastructural, and technological challenges. The insights from IRENA’s report underscore the importance of standardisation, infrastructure development, and international collaboration in building a robust green hydrogen economy.

With strategic investments and regulatory alignment, India can position itself as a leader in the green hydrogen market. Contributing not only to its own energy transition goals but also to the global push for decarbonisation. By focusing on green hydrogen derivatives like ammonia and methanol, India can secure a pivotal role in the sustainable energy future, aligning economic growth with environmental stewardship.