The global energy landscape is undergoing a transformation, and hydrogen is at the heart of this revolution. Once considered a niche energy source, hydrogen is rapidly gaining traction as a crucial component in the quest to decarbonise global economies and achieve climate goals. The latest report, Hydrogen Insights 2024, authored by the Hydrogen Council in collaboration with McKinsey & Company, offers an in-depth analysis of the hydrogen sector’s remarkable progress, challenges, and its pivotal role in shaping the future of energy.

Seven fold investment surge: Hydrogen’s rapid growth

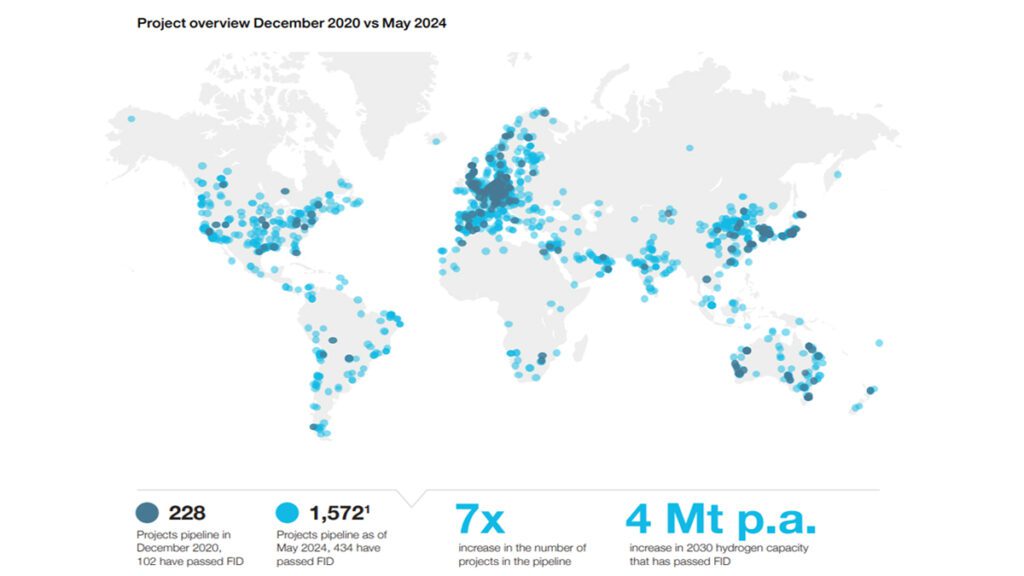

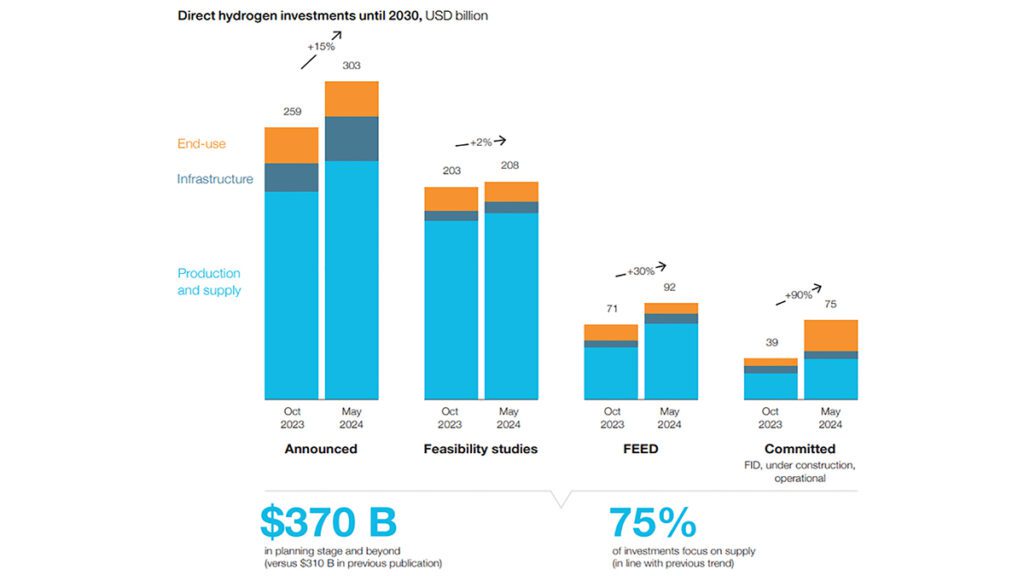

In the past four years, the global hydrogen industry has experienced exponential growth in terms of project investment and deployment. According to the report, the number of hydrogen projects that have reached final investment decision (FID) has increased seven-fold, from 102 projects in 2020 to 434 in 2024. This represents a staggering increase in committed capital from $10 billion to $75 billion. This growth is a testament to the industry’s determination to scale up clean hydrogen production and integrate it into the global energy mix.

Jaehoon Chang, President and CEO of Hyundai Motor Company and Co-Chair of the Hydrogen Council, highlighted this momentum, stating: “The seven-fold increase in committed capital for hydrogen projects reaching FID over the past four years demonstrates the industry’s progress. We are pleased to see the industry walking the talk at this critical transitional moment, as evidenced in the latest Insights report. Moreover, further action is needed to ensure an accessible and affordable hydrogen supply, enabling the widespread adoption of hydrogen.”

Chang’s emphasis on the need for accessible hydrogen aligns with the report’s findings that while hydrogen investment is growing, there remain significant challenges to making hydrogen a widely used, affordable energy source.

Overcoming obstacles: Inflation, interest rates and regulatory uncertainty

Despite the impressive progress, the hydrogen sector is not without its challenges. Like other clean energy industries, hydrogen is facing macroeconomic headwinds such as rising inflation, higher interest rates, and geopolitical tensions that have disrupted energy markets globally. The conflict in Ukraine, for instance, has caused a ripple effect in global energy prices and supply chains, adding to the difficulties in accelerating hydrogen projects.

Sector-specific challenges, including regulatory uncertainty and increasing costs for renewable power and electrolysers, have also hindered the hydrogen industry’s progress. These issues are particularly pronounced in renewable hydrogen projects, where the cost of renewable energy inputs has escalated, leading to delays in project completion.

Ivana Jemelkova, CEO of the Hydrogen Council, echoed these concerns: “This report sends a clear message: hydrogen is happening. Now that hydrogen is a reality in the energy transition, it’s time to drive significantly more investment by 2030 to meet our mid-century targets. Equipped with concrete lessons learned from the past four years, we must urgently address challenges in key markets and create a more favourable environment for project execution.”

Jemelkova’s comments underscore the need for stronger policy frameworks and incentives to keep hydrogen projects on track. Regulatory clarity, combined with economic incentives, will be essential to overcoming these barriers and ensuring the industry continues its rapid expansion.

Role of governments and the private sector

One of the central themes of the Hydrogen Insights 2024 report is the importance of collaboration between governments and the private sector. As hydrogen becomes a critical component of the energy transition, both public and private stakeholders must work together to accelerate its deployment.

Sanjiv Lamba, CEO of Linde and Co-Chair of the Hydrogen Council, highlighted this collaborative effort: “Realising hydrogen’s full climate and socio-economic potential requires a united effort from governments and industry. With a supportive regulatory framework and targeted incentives, investors will have the certainty they need to move projects to FID – ultimately contributing to achieving global climate targets.”

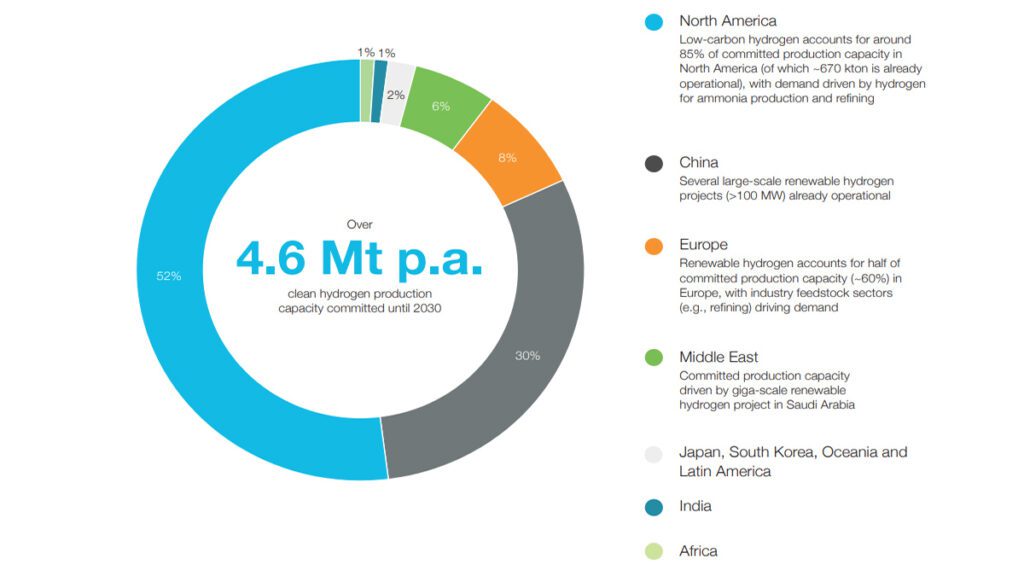

The report points to several success stories where government incentives have played a pivotal role in advancing hydrogen projects. For instance, the United States has seen a significant boost in low-carbon hydrogen capacity thanks to the 45Q tax credit for carbon capture and storage (CCS) projects. In Japan, demand-side visibility for hydrogen, driven by contract-for-difference mechanisms for power production, has also spurred investments. China, too, has seen a rise in hydrogen project maturity due to strong industrial policies that have helped drive down costs through large-scale deployment.

Project pipeline and maturity: A global perspective

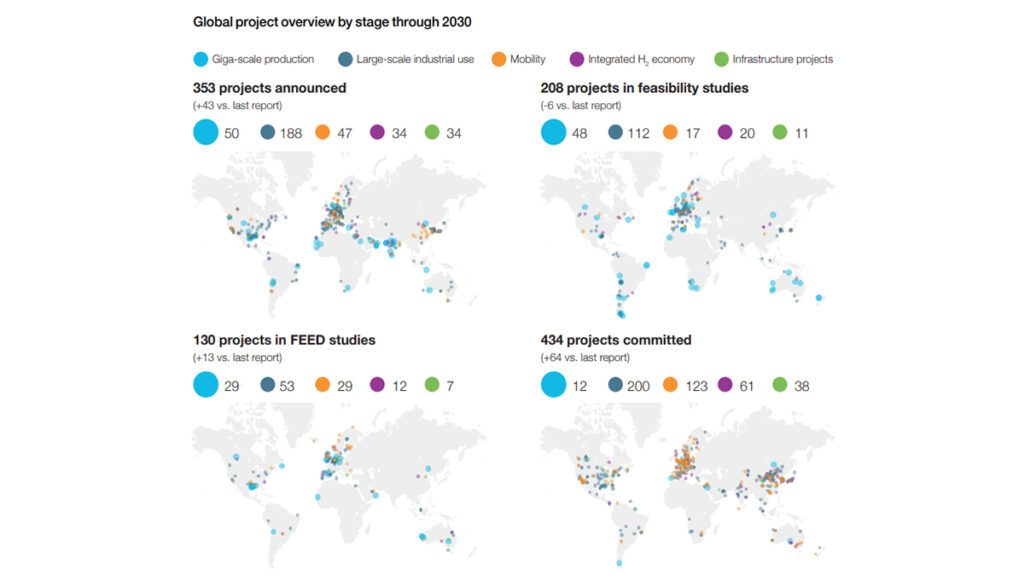

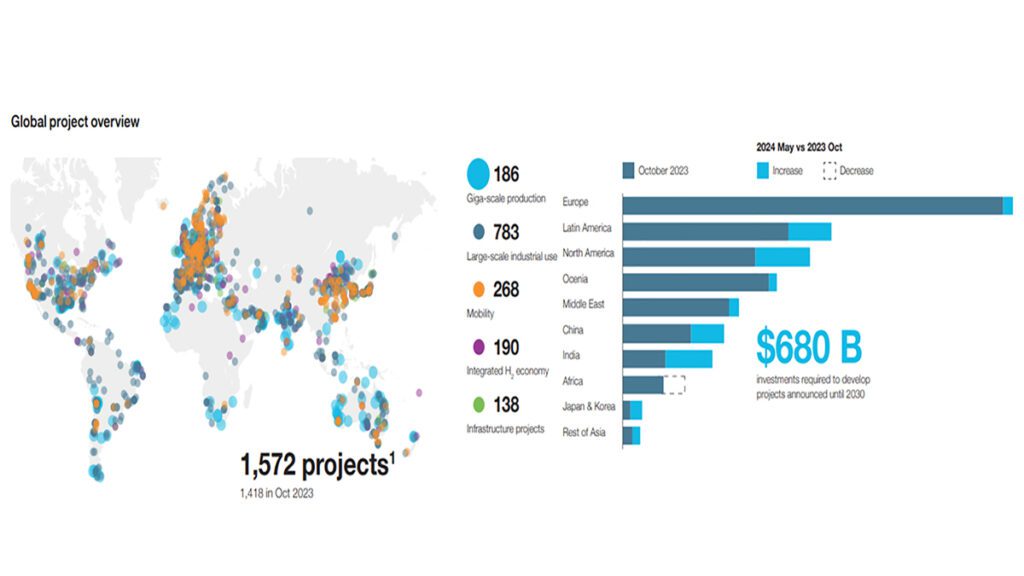

The report highlights the impressive growth in the global hydrogen project pipeline, which has expanded from 228 projects in 2021 to 1,572 projects in 2024. While the number of projects has increased significantly, the pipeline has also matured, with more projects moving beyond the announcement phase and into advanced stages of development. This includes an increase in front-end engineering design (FEED) projects, which have grown 20-fold over the past four years.

Natural attrition has played a role in maturing the industry, with less viable projects being phased out and stronger projects moving forward. This trend is consistent with other fast-growing climate technologies, such as solar and wind, where only a fraction of announced projects ultimately reach commissioning.

Despite the robust growth, the report acknowledges that the current pace of hydrogen deployment is not yet sufficient to meet global climate targets. To remain on track with decarbonisation goals, the report calls for an eight-fold increase in hydrogen investments by 2030. Governments and industry stakeholders must act swiftly to mobilise the necessary capital and create the regulatory frameworks needed to bring projects to fruition.

The importance of infrastructure and end use investments

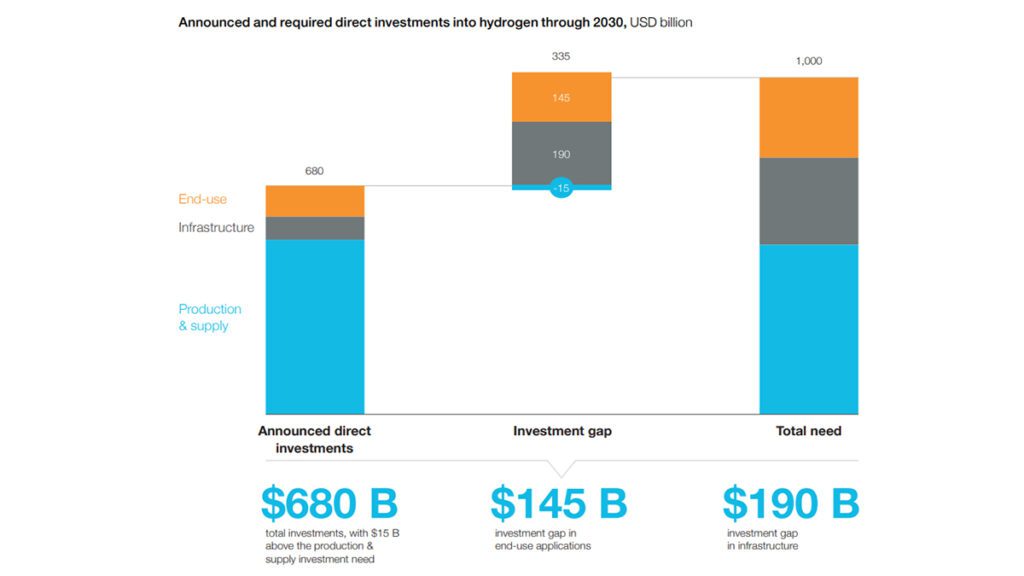

While investment in hydrogen production has surged, the report identifies significant gaps in other parts of the hydrogen value chain. Infrastructure and end-use applications are two areas that require substantial additional investment if hydrogen is to become a cornerstone of the global energy system.

According to the report, $680 billion in direct investments have been announced through 2030, with the majority (75%) focused on hydrogen supply projects. However, there is a $190 billion investment gap in hydrogen infrastructure and a $145 billion gap in end-use applications. Closing these gaps will be critical to ensuring that hydrogen can be transported, stored, and used in a variety of sectors, including mobility, industry, and power generation.

The report highlights the need for additional investments in hydrogen infrastructure, particularly pipelines and refuelling stations. There are currently around 5,000 km of hydrogen pipelines globally, but this figure must grow significantly to accommodate the anticipated increase in hydrogen production. The deployment of hydrogen refuelling stations is also lagging, particularly in Europe and North America, where growth has stagnated. By contrast, China, Japan, and South Korea have continued to expand their refuelling networks, with over 850 stations currently in operation across the three countries.

Clean Hydrogen: Critical component of the energy transition

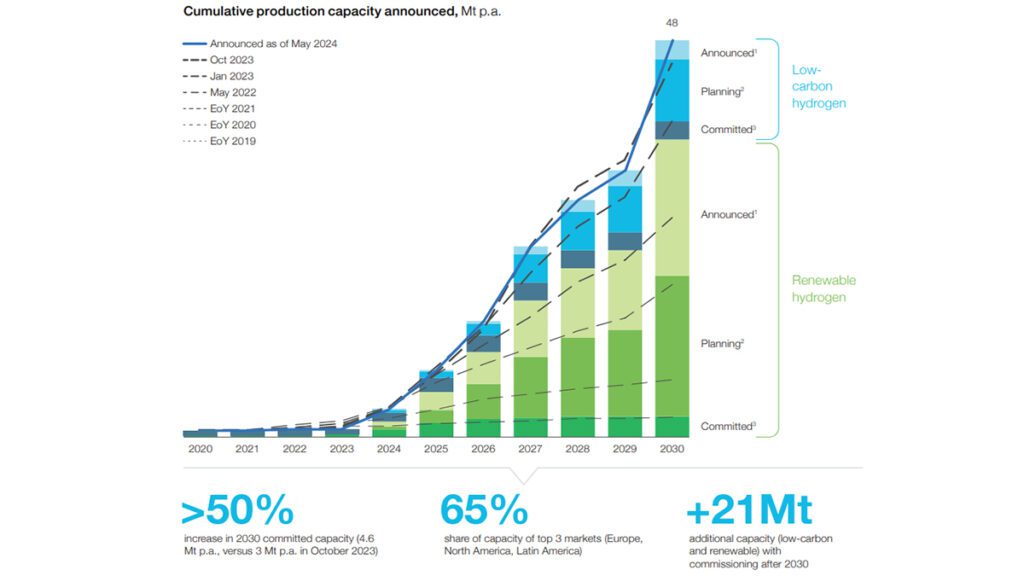

One of the most encouraging findings of the report is the continued shift towards clean hydrogen, which includes both renewable and low-carbon hydrogen. As of 2024, 75% of the announced hydrogen production capacity is renewable, up from 60% in 2020. This shift is largely driven by projects in regions with abundant renewable energy resources, such as Latin America, Australia, and the Middle East.

However, the report also notes that low-carbon hydrogen, produced using technologies like CCS, will continue to play a significant role in the energy transition. In regions like North America, where CCS is more advanced, low-carbon hydrogen projects account for a large share of the total capacity.

The probability-adjusted forecast for 2030 suggests that 12-18 Mt of clean hydrogen could be deployed globally by that year, with two-thirds of this coming from renewable hydrogen and the remainder from low-carbon sources. While this is a significant increase from today’s levels, it still falls short of the 48 Mt of capacity that has been announced, highlighting the need for additional investments and policy support to bring these projects to fruition.

Hydrogen’s role in a decarbonised future

The Hydrogen Insights 2024 report paints a picture of an industry that is rapidly gaining momentum but still faces significant challenges. With a seven-fold increase in project investments and a growing pipeline of projects, the hydrogen sector is well on its way to becoming a key player in the global energy transition. However, to fully realise hydrogen’s potential, governments and industry stakeholders must address the remaining challenges, including regulatory uncertainty, infrastructure investment gaps, and the need for continued innovation in hydrogen production technologies.

As Jaehoon Chang, Ivana Jemelkova, and Sanjiv Lamba have emphasised, the path to a hydrogen-powered future will require collaboration, investment, and a shared commitment to overcoming the obstacles that lie ahead. With the right support, hydrogen could become the backbone of a sustainable, decarbonised global economy, delivering both climate and socio-economic benefits for generations to come.